Contact the Tax Administration to find out if you have to file or not.

#LAST YEAR TAX RETURN PROFESSIONAL#

If you are a self-employed professional working on an assignment in the Netherlands, you may have to file an income tax return, depending on several circumstances. However, if your business is not in the Netherlands, but you have employees working temporarily in the Netherlands, you are normally not liable for paying income tax in the Netherlands. Generally speaking, the rule is that if you receive income from the Netherlands, you are liable to pay income tax, even if you do not reside in the Netherlands. If you are registered with the Netherlands Chamber of Commerce KVK, either as a resident business or a business with a branch in the Netherlands, you will receive a declaration letter to file for income tax. What if you do not reside in the Netherlands? Businesses that are not legal entities, like a sole proprietorship or a general partnership, file an income tax return. In the Netherlands, legal entities are required to file a corporate income tax return. Is the amount to be paid less than € 48? Then you do not have to file a declaration. If it appears that you will receive a refund of € 16 or more, file a declaration. As long as you do not send the data, you will not file a declaration.Īfter you have completed (but not yet send) your declaration, you will immediately see the result. You can check it by filling in a test declaration on Mijn Belastingdienst (only in Dutch). For example, if your savings exceed the tax-free allowance. Read more about deductions ( aftrekposten, in Dutch). The tax authorities do not have all your data data, such as your medical expenses.

For example, if you have deductible items. You also have to file an income tax return if you have not received a letter, but have earned income in the Netherlands.ĭid you not receive a letter? You can check whether you have to file a tax return. Do you have to file a Dutch income tax return?Įveryone who receives a declaration letter from the Dutch Tax and Customs Administration has to file an income tax return. The Belastingdienst gives an overview of information you need when filing your tax return.

#LAST YEAR TAX RETURN DOWNLOAD#

Once you have obtained your DigiD, you can go to the website of the Dutch tax authorities and download the electronic tax return program. If you live abroad, read here about applying for a DigiD. Either way, you need a DigiD to verify your identity. You can file your tax return yourself, using tax return or financial administration software, or via a tax intermediary. It is possible to apply for an extension.

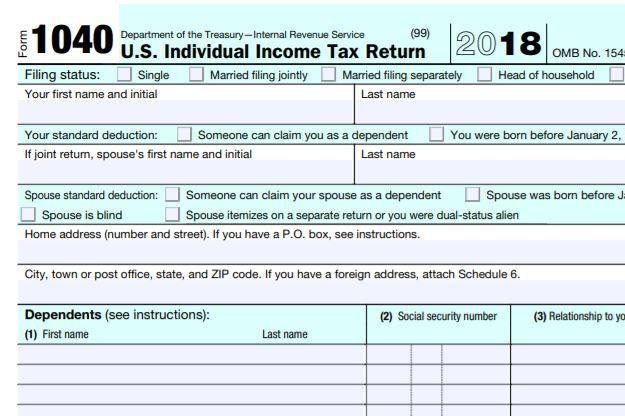

You can find the form in the encrypted environment of the website, Mijn Belastingdienst (only in Dutch), from 1 March.įile your income tax return before 1 May. You have to file your income tax return digitally. The Tax Administration uses the return to determine your tax assessment: will you have to pay tax, or get a tax refund? File your tax return correctly and before 1 May You must file your income tax return with the Dutch Tax and Customs Administration before 1 May of each year. Taxable earnings are your earnings minus deductibles and fiscal schemes, such as costs made for your company or amortisations. In the Netherlands, you pay income tax over your taxable earnings.

0 kommentar(er)

0 kommentar(er)